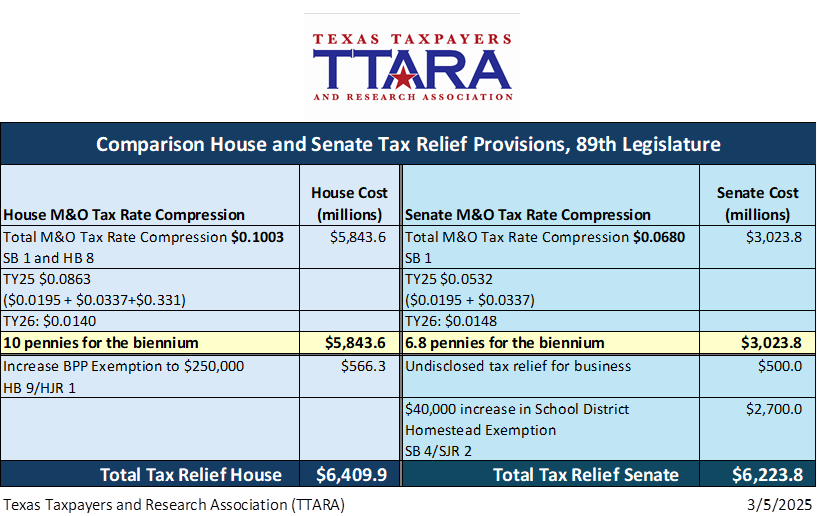

Both the House and Senate continue to work on their respective tax relief packages for this session, and neither has reached Governor Abbott’s $10 billion goal. The House package is estimated at $6.4 billion, and the Senate package $6.2 billion.

Both the House and Senate budgets (HB 1 and SB 1) have $0.068 of ongoing school district maintenance and operations rate compression under current law.

The House would add an additional $0.0331 of compression via HB 8 by Meyer, which was heard in the House Ways and Means Committee on Monday and we expect to be voted out of committee very soon. In addition, HB 9 by Meyer would increase the business personal property exemption from $2,500 to $250,000.

The Senate has passed a $40,000 increase in the school district homestead exemption, embodied in SB 4 and SJR 2. Senator Bettencourt stated on the Senate floor that a letter from the Legislative Budget Board puts the cost to hold school districts harmless for the lost value at $2.7 billion in the upcoming biennium. The Senate budget also has $500 million set aside for “tax relief for business” but it is not clear what that entails.

A chart comparing the tax relief packages to date in each chamber is below.